TAX PAYMENT INSPECTION OF CUSTOMS DECLARATIONS

The One Logistics will provide detailed instructions on how to look up and pay customs declarations in the article below:

What is customs declaration tax?

When we export or import certain items to Vietnam, we will need to pay import and export tax and value added tax (VAT) if any to the state. The customs declaration tax is actually the export or import tax rate, VAT when we do import and export of goods.

How to pay customs declaration tax?

Currently, to pay tax on customs declarations, we have two ways:

- Pay directly at the customs branch, at the bank, or the state treasury.

- Pay customs tax online online.

According to the trend of modernization of the customs field, online payment of customs declarations online is becoming more and more popular, paying more quickly and without fear of losing the original tax payment documents.

Steps to look up and pay tax on customs declarations:

I. Look up and pay customs declarations on the internet:

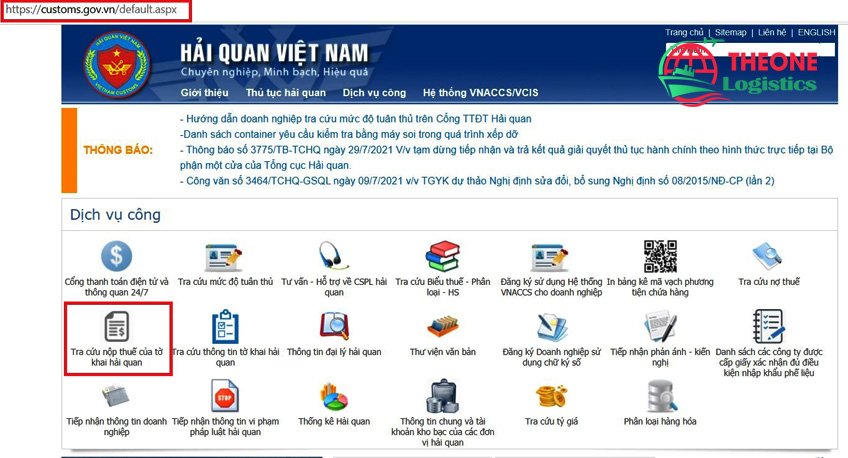

By accessing the homepage of the General Department of Customs at: https://customs.gov.vn/default.aspx we can do this.

Then select the item "Look up tax payment of the customs declaration" to switch to the main working interface.

II. Enter parameters to look up and pay tax returns:

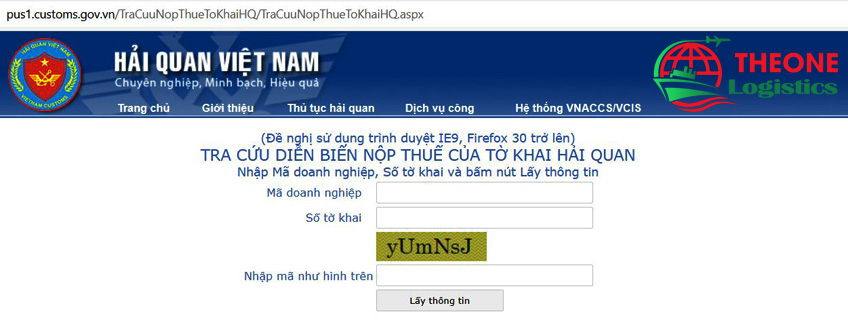

At this interface, you enter the parameters as instructed, including: Business tax code, customs declaration number, enter security code (note that you need to enter the correct uppercase and lowercase letters).

III. Read the search results of tax payment declaration:

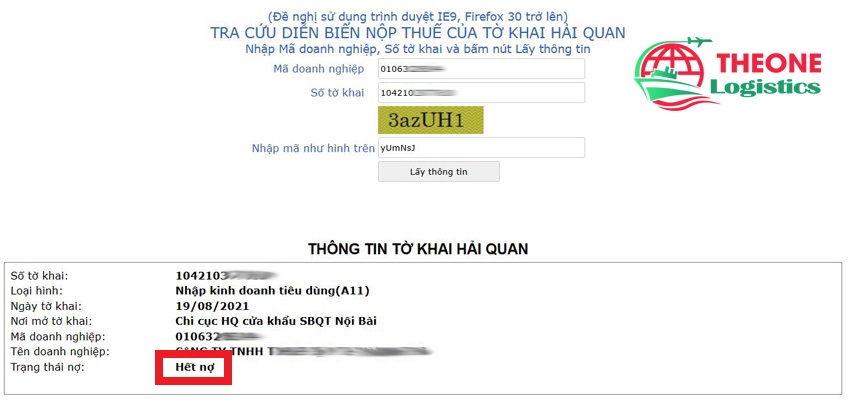

The customs tax payment search results include two parts: information on customs declarations and information on tax payments.

- In the "Customs declaration information" section, you will see a full display of information such as: declaration number, type code, declaration date, declaration opening, business tax code, business name import and export and especially debt status. If the debt status is "Out of debt" as shown below, the business has successfully paid taxes and no longer owes taxes.

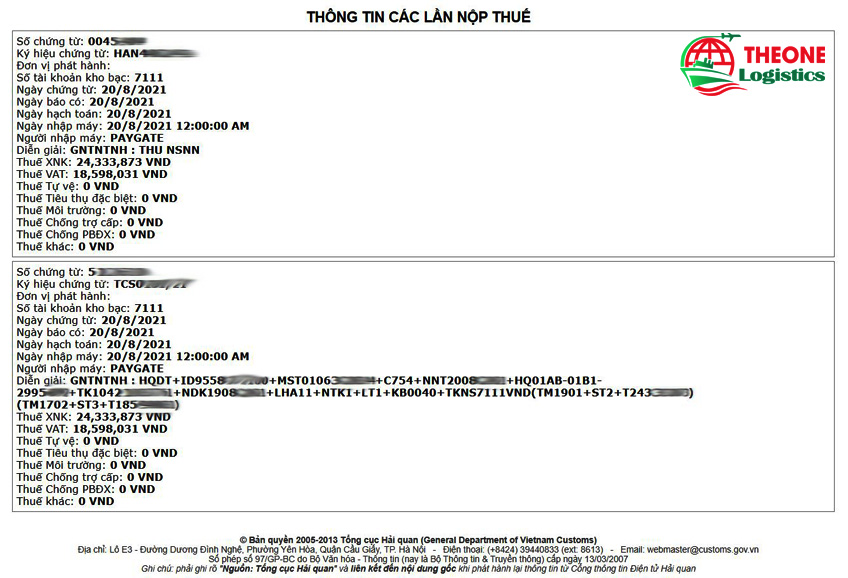

- In the section "Information about tax payments" you will be returned the results of your business's tax payments. Here, we can see the treasury account number, credit date, accounting date, machine import date, import and export tax, VAT, self-defense tax, excise tax, environmental tax, etc. prize...

So, when we hold any customs declaration in hand with an internet-connected device, we can look up tax payment information by ourselves anywhere. Have a nice day!

In addition, if you have a need for customs clearance services, air freight services, ocean freight, do not hesitate to contact us via hotline: 0973.266.672 (Mr Thang) to be provided. Free consultation and service.

See more:

Instructions for looking up information on customs declarations

International air freight service

Sea freight services to countries

Related Products

Tags: lookup tax payment, look up tax debt, pay customs tax, pay taxes, pay tax returns, pay customs declarations, look up and pay customs duties, look up and pay tax returns, customs duties, export taxes import, import tax, export tax, look up declaration information, look up customs declaration information

.jpg)

/(Dừa) Thủ tục xuất khẩu nông sản - dừa tươi - dừa kim cương/Thu-tuc-xuat-khau-nong-san---dua-tuoi---dua-kim-cuong.jpg)

/(Sầu riêng) Thủ tục xuất khẩu nông sản - sầu riêng đông lạnh/Thu-tuc-xuat-khau-nong-san---sau-rieng-dong-lanh-2.jpg)