PROCEDURES FOR IMPORTING COSMETICS

ASC Logistics provides quick, safe and professional import procedures.

1. Procedures for importing cosmetics: Before importing, they must apply for permits

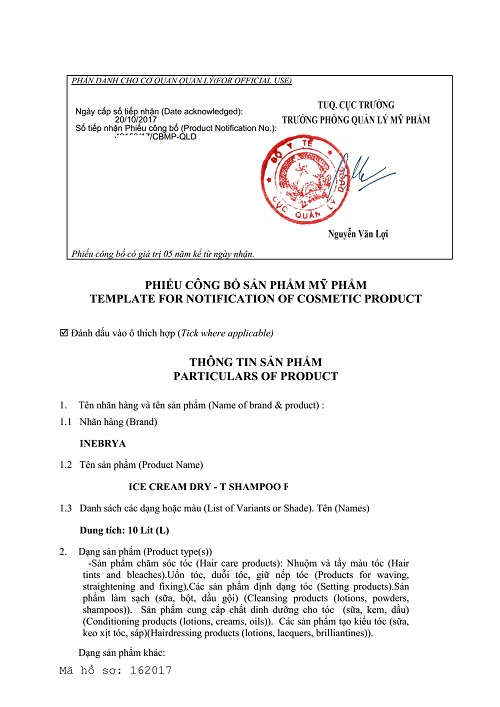

Cosmetics are special items, under the management of the Drug Administration - Ministry of Health. Therefore, before importing cosmetics into Vietnam, enterprises should do: Announce cosmetics according to Circular 06/2011 / TT-BYT. This publication is valid for 5 years from the date of issuance of the form as shown below

So you need to remember, it is necessary to make cosmetics before importing cosmetics to Vietnam

2. Procedures for import of cosmetics: HS code and import tax on cosmetics

Below is the code HS code and import tax of some common cosmetic items:

- HS code of shower gel: 34013000. The usual preferential import tax is 27%, the import tax on shower lot from Korea, the use of C / O FORM AK is 20%, the import tax on shower gel from Thailand, Malaysia, using C / O FORM D is 0%, Import tax on shower gel from China using C / O FORM E is 0%, Value Added Tax: 10%

- HS code of shampoo: 33051090. Generally preferential import tax is 15%, Shampoo import duty from Korea, use C / O FORM AK is 10%, Shampoo import duty From Thailand, Malaysia, using C / O FORM D is 0%, Shampoo Import Tax from China using C / O FORM E is 0%, Value Added Tax: 10%

- HS code of facial cleanser: 33049930. Generally preferential import tax is 20%, import tax on facial cleanser from Korea, unused C / O FORM AK is 20%, import tax on washing milk From Thailand, Malaysia, using C / O FORM D is 0%, Imported Dust Liquid from China using C / O FORM E is 0%, Value Added Tax: 10%

- HS code of body milk: 33049930. Generally preferential import tax is 20%, import tax on body milk from Korea, can not use C / O FORM AK is 20%, import tax on milk From Thailand, Malaysia, using C / O FORM D is 0%, Duty to import formula from China using C / O FORM E is 0%, Value Added Tax: 10%

- HS code of skin lotion: 33049930. The usual preferential import tax rate is 20%, the import tax on Korean skin lotion, can not use C / O FORM AK is 20% Skin from Thailand, Malaysia, using C / O FORM D is 0%, Imported lotion from China using C / O FORM E is 0%, Value Added Tax: 10%

- HS code of lipstick: 33041000, the usual preferential import duty is 20%, the import duty of lipstick from Korea, can not use C / O FORM AK is 20%, import tax lipstick From Thailand, Malaysia, using C / O FORM D is 0%, Imported lipstick from China using C / O FORM E is 0%, Value Added Tax: 10%

- HS code of the skin mask: 33049990, the usual preferential import tax rate is: 20%, import tax mask skin from Korea, can not use C / O FORM AK is 20%, import tax Mask from Thailand, Malaysia, using C / O FORM D is 0%, Imported face mask mask from China using C / O FORM E is 0%, Value Added Tax: 10%

- HS code of hair dye: 33059000, the usual preferential import duty is 20%, import tax on hair dye from Korea, unused C / O FORM AK is 20%, import tax on dye Hair from Thailand, Malaysia, using C / O FORM D is 0%, Imported Hair Dye from China using C / O FORM E is 0%, Value Added Tax: 10%

/Th%E1%BB%A7%20t%E1%BB%A5c%20nh%E1%BA%ADp%20kh%E1%BA%A9u%20m%E1%BB%B9%20ph%E1%BA%A9m/Thu-tuc-nhap-khau-my-pham-3.jpg)

3. Procedures for import of cosmetics: Customs procedures

After the announcement of cosmetics, cargo landing, or airport, customers declare e-customs. Normally, cosmetic products are checked for actual match against the published cosmetic products

Note when using the announcement of cosmetic customs procedures:

The composition of the product varies by month and year. Before each new shipment, should the enterprise check the change of product composition? If there is a change, make a new product announcement. Avoid cases, when goods are docked, Customs recommends opening containerized goods. If the ingredient on the original label of the product does not match the publication. Enterprises will be administratively sanctioned from 30 to 50 million and within 30 days from the sanctioning date, enterprises must supplement the new declaration. If more than 30 days, the enterprise can not present a new declaration, customs will carry out re-export procedures.

A dossier of customs procedures shall include:

- Invoice, packing list: Copies (sign, stamp, title and not stamped: Duplicate original)

- Bill: Original bill, or telex bill, surrender bill (snapshot)

- Sea freight invoices and CIC invoices at Hai Phong and Cat Lai ports: in case of buying FOB price

- Invoice at the port of export: In case of purchase price Exw

- Receipt of cosmetic announcement: a copy, case announced in January 2016. In case of publication from 2012, 2013, the enterprise should present the original cosmetic statement and photocopy to the customs officer for verification of the authenticity of the dossier.

From 2016, make an online cosmetic publication so the business presents the snapshot. In case of necessity, the customs officer will request the same ID and pass word to log into the 1 door system and check the original on the system.

These are the most necessary documents for customs clearance. After submitting the full dossier, the customs office shall check and clear the declaration at the time of customs clearance.

/Th%E1%BB%A7%20t%E1%BB%A5c%20nh%E1%BA%ADp%20kh%E1%BA%A9u%20m%E1%BB%B9%20ph%E1%BA%A9m/Thu-tuc-nhap-khau-my-pham-2.jpg)

To find out more about cosmetic procedures or use our full package of cosmetic import services, call hotline: 090.328.8872 (Mr Thang)

Related Products

Tags: Procedures for importing cosmetics, customs procedure

.jpg)

/(Dừa) Thủ tục xuất khẩu nông sản - dừa tươi - dừa kim cương/Thu-tuc-xuat-khau-nong-san---dua-tuoi---dua-kim-cuong.jpg)

/(Sầu riêng) Thủ tục xuất khẩu nông sản - sầu riêng đông lạnh/Thu-tuc-xuat-khau-nong-san---sau-rieng-dong-lanh-2.jpg)