E-CUSTOMS DECLARATION

ASC Logistics guides the e-customs declaration details to the new and fresh feet of the logistics industry.

When referring to the import and export sector, it is indispensable a very important business is the customs declaration. Unlike before, the customs clearance of goods is verified through the paperwork and processing time is usually very long, sometimes up to 5-7 days for a declaration, the current customs declaration has become Easier with the electronic customs VNACCS / VCIS. This system is applied in the context of Vietnam's deep international integration, import-export activities are increasingly developed and help businesses save costs as well as goods clearance time.

1. What is e-customs declaration?

- E-customs declaration: It is a form of importing customs information with pre-installed software on the computer and then transmits the customs declaration to the customs office via the Internet and proceeds to clear the goods.

/D%E1%BB%8Bch%20v%E1%BB%A5%20th%C3%B4ng%20quan%20h%C3%A0ng%20ho%C3%A1/Dich-vu-thong-quan-hang-hoa.jpg)

- Manual customs declaration: Customs declarants manually fill in the declaration form and then submit the declaration form together with some documents such as contract, packing list, invoice, C / O, B / L. , ...) to the customs office for clearance of goods.

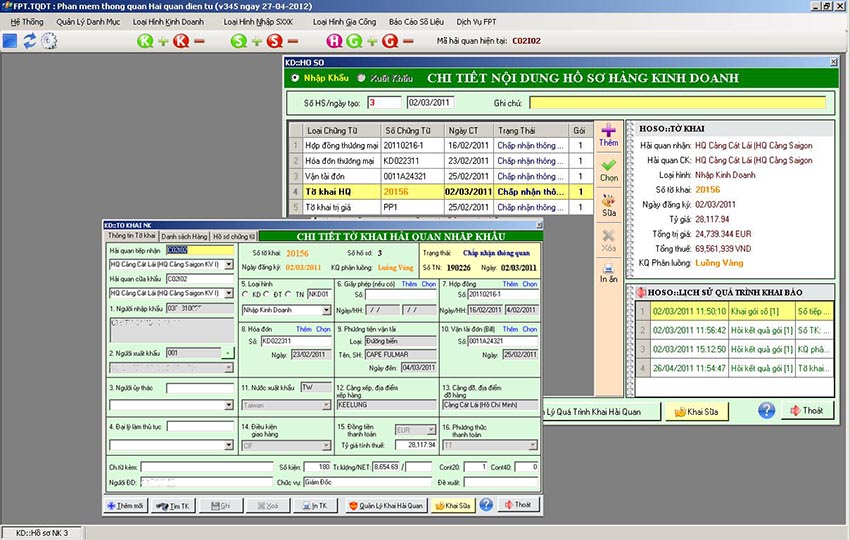

- Currently there are 2 software used for e-customs declaration are Thai Son Software (Ecus, latest version is Ecus 5), and FPT (named FPT.TQDT, upgraded from AiKTX or FPT.KTX). In 2014, the customs has introduced the automatic VNACCS / VCIS Automated Customs Clearance System. The VNACCS / VCIS system consists of many softwares. In that, the owner will pay much attention to the software. After, especially e-customs declaration software:

- + Electronic Declaration (e-Declaration);

- + Electronic Manifesto (e-Manifest).

- + Electronic invoice (e-Invoice);

- + Electronic C / O (e-C / O);

- + Electronic payment (e-Payment);

2. How to register e-customs.

Enterprises must register e-customs procedures to use this form. The enterprise shall fill in the customs office's application form and submit it with the business registration certificate to the Customs Sub-Department. Results will be announced after 8 working hours.

3. Method of e-customs declaration.

Step 1: Declaration and transmission of the declaration.

The person submits the declaration in accordance with the criteria and standard format and then sends it to the customs office

Note :

Make sure that you have the correct port of entry to the customs department that manages your port or CFS store.

The contract must have an end date.

Net weight and gross weight are expressed in KG units.

In the vehicle information you will need to complete your citizenship and expected date of arrival (ETA)

The net can be checked with the carrier. If you do not know the nationality of the ship, use the country code for the shipment to fill in.

After completing the data declaration, click on "get results" button to receive feedback from the customs office.

Step 2: After the data transmission, you will receive feedback from the customs authorities.

Click on the "Get Results" button twice, the first time to receive the customs clearance number, the second (after the first 10p-15p) to receive the customs declaration number.

Once the customs declaration number has been received, the customs officer will divide the declaration sheet by 1 hour, continue to press the "get results" button. Then, print the declaration from the software and port of import and export procedures

In case you make a false declaration, the system will detect the error, and will inform you on the computer screen, you need to correct the correct and retransmit.

Once the steps have been completed and the preliminary data is valid, you have received the declaration number and the result stream. You will do one of the following:

Green channel: Passing the flow declaration, everyone just hope to receive this result, at

This thread is exempt from inspection of paper records and exempt from actual inspection. So, you go straight to step 3.

Yellow: Your goods need to be checked customs records. After checking if the customs office requests the modification or supplementation of the customs dossier, the enterprise shall comply with the request and produce the paper dossier for inspection by the customs office.

Red: The customs office will check both the paper and the goods of the enterprise.

When using VNACCS for customs declaration, the speed of customs clearance is quite fast: For green stream only takes about 1-3 seconds, just click that will result in streaming immediately. As for gold or red, the processing time depends on the degree of adjustment of the record and the goods.

Note: If you want to edit the declaration information, it is mandatory to wait until a new declaration number is declared. If carrying out import procedures, enterprises need to print two electronic declarations and tax notice. If the enterprise has corrected the declaration after the STK declaration form, it is necessary to print an amended declaration, in which the information must be added before editing, after editing, marking and signing. electronic declaration. The printed declaration must have a valid new bar code.

Cancellation Declaration: After making the declaration, the number of customs declarations and the result of dividing the users who want to cancel the declared declaration, select "Declare the declaration", save the declaration, Declaration, continue to choose to save the declaration, select "Declare the Korean", you will receive new Korean receiver number and the result of Korea has agreed to cancel or not

If declaration after cancellation declaration is returned to HQ, the person who filed the application together with information of STNHQ of the declaration has just been submitted to the Korean officials to complete the declaration.

Step 3: Print the declaration and get the goods.

You need to print the declaration, including Green flow, to the customs department to submit the file for customs clearance at the customs department before the port to clear the goods.In case the company does not want to buy software for self-declaration, you can look for a customs service company to do this job.

Please contact ASC Logistics for a free consultation on e-customs declaration and use customs clearance services for import and export goods. Hotline: 090.328.8872 (Mr Thang)

>>Please see Video of the e-customs declaration form ECUS5 - VNACCS

Related Products

Tags: e-customs declaration

.jpg)

/(Dừa) Thủ tục xuất khẩu nông sản - dừa tươi - dừa kim cương/Thu-tuc-xuat-khau-nong-san---dua-tuoi---dua-kim-cuong.jpg)

/(Sầu riêng) Thủ tục xuất khẩu nông sản - sầu riêng đông lạnh/Thu-tuc-xuat-khau-nong-san---sau-rieng-dong-lanh-2.jpg)